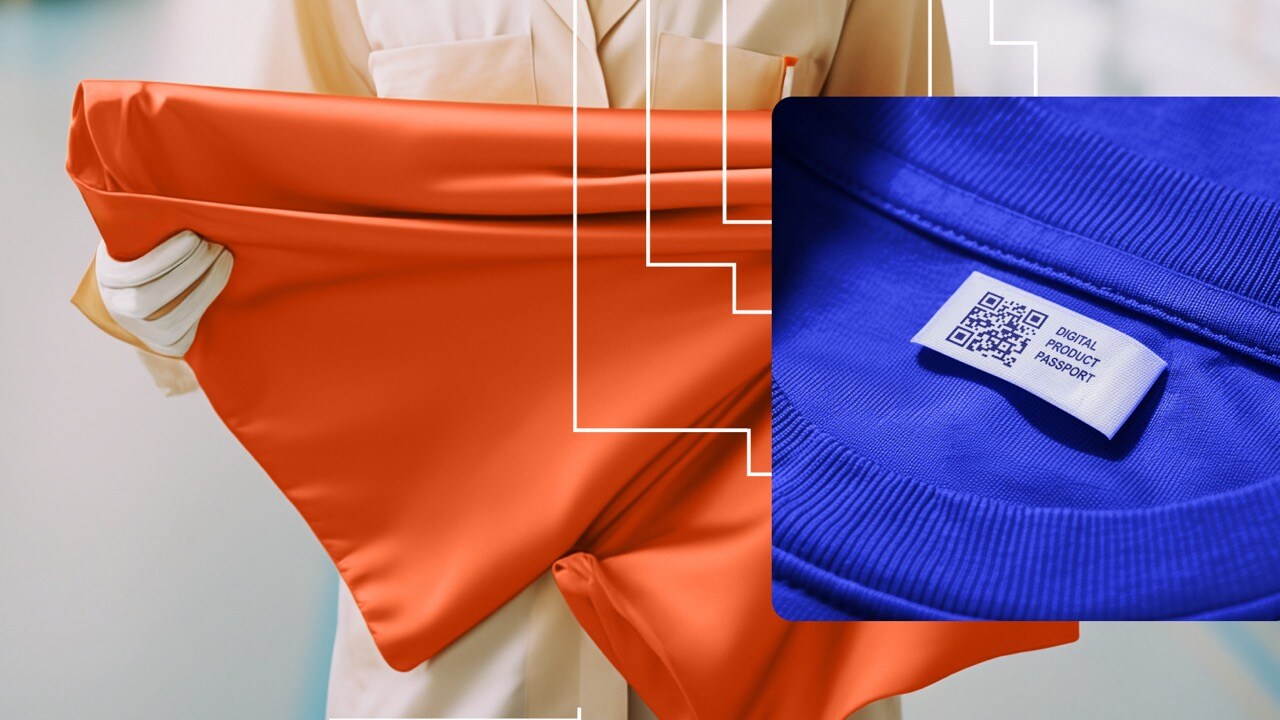

Amidst the uncertainties surrounding the ESPR and DPP requirements, TrusTrace remains dedicated to collaborating with brands to streamline data collection and facilitate the industry's shift towards transparency and circularity. This commitment led TrusTrace to participate in the Trace4Value pilot project, alongside GS1 Sweden, popular Nordic brands like Kappahl and Marimekko, and other tech partners. Together, they successfully crafted prototypes of the Digital Product Passport (DPP) tailored to the fashion and textile sectors, as detailed in the informative playbook, Unlocking DPP.

In the following article, we delve into 3 key learnings from the pilot project on how to gather data for the DPP. Use these strategies to enhance your data infrastructure and set your organization up for success to implement Digital Product Passports for all your products and fulfil ESPR obligations.

scope: how to gather the data for dpp

As part of the DPP pilot project called Trace4Value, TrusTrace together with the working group had 4 key goals:

1. Define the data protocol for the DPP that is in line with current regulations, brand needs, and consumer preferences in the textile industry.

2. Implement standards and protocols to ensure interoperability of the DPP system with other product data software.

3. Establish the necessary architecture and infrastructure to collect, link, and share DPP data according to ESPR guidelines.

4. Create a user-friendly interface linked to the scannable data carrier for consumer interaction.

The results and the data parameters can be viewed in detail in the Data Protocol whitepaper. The remaining of this article will answer the question, "how do you gather the data?" We've articulated the key insights including how to set up the data infrastructure and other considerations for the digital product passport.

1) Prioritize Data Needs

The lack of clarity in data definitions within the ESPR guidelines posed a challenge in fully defining the protocol. Despite participating brands including Kappahl and Marimekko not having all the required data, they prioritized fulfilling critical data sources while setting aside the unclear or optional ones.

For instance, uncertainties surrounding the product carbon footprint methodology in the ESPR guidance led brands to hesitate in including such data to avoid potential breaches of Green Claims legislation. Instead, brands focused on conveying areas of interest to consumers, such as supply chain traceability or material impacts, to engage them on the product's environmental footprint.

2) Collect the Right Data

The data protocol can be thought of as containing two types of datapoints:

- Objective ‘direct’ ones - like the country of product manufacture, as well as subjective ‘methodology-dependent’ ones - like footprint calculations. The objective ones are defined and within reach already.

- The subjective ones relate to ‘macro-industry’ standards and methods that must be set at the industry level – all brands are in the same boat when it comes to waiting for those decisions to be made. This will be addressed in the Delegated Acts down the line.

3) Enable Information Sharing

The pilot threw up a communications curveball in terms of data sharing with consumers. For brands manufacturing products for distribution to markets both inside and outside the EU, the inclusion of DPP data carriers on all of them was possibly problematic.

During the pilot data evaluation, one brand determined that some data was EU-centric, and either not relevant or possibly inaccurate for consumers outside of the EU, should they scan the QR code and view the data displayed in the consumer interface. In order to deploy DPP data carriers across entire production runs, the brand was hoping for clarity that would ensure data was not EU-centric, and assurances that any disclosures required in the DPP were not at odds with consumer data privacy in markets outside of the EU.

Learnings

The brands involved in the pilot worked across internal departments to collect the data required for DPP, spanning: sustainability, merchandising, quality and IT.

Whilst this required more resources and effort than predicted, it highlighted the potential for shifting DPP from sustainability to product and merchandising departments where it could be used to add value to consumers and better respond to their needs and their role in product use, care and wider brand engagement.

To take this point further, it showed how DPP could offer a bridge between sustainability and sales, connecting what can be otherwise an isolated department separated from the business ‘bottom line.’

This is just an excerpt from the playbook Unlocking DPP: The Why, What and How of Digital Product Passports. Get the full report and industry insights in the guide over on the Guides page.