Overview

What does it mean?

The US Securities and Exchange Commissions (SEC)* issued the Climate-Related Disclosure Rules proposition that would require listed companies in the United States to include climate-related information in their reporting. This information should cover the climate-related risks for the company and how these risks are managed internally. Companies will also have to disclose their greenhouse gas (GHG) emissions and their plan to reduce them if any. The enforcement will roll-out in phases and companies with a public float** of more than $700M will be expected to start disclosing these details by 2023.

The SEC began to tackle this issue in the 1970s and proposed a guidance in 2010 on how companies should report their climate-related risks as there was a strong push from the investors. This proposition standardizes and enhances the climate-related disclosure rules as the investors have required more relevant and comparable information.

* The Securities and Exchange Commission is an independent agency of the US federal government created in 1934 following the 1929 Wall Street Crash. Its main purpose is to fight market manipulation by regulating the securities markets and protecting investors. The SEC is the organization that enforces the public companies to submit quarterly and annual financial reports. An explanatory article and video can be found here.

Who is impacted?

All companies publicly listed in the US will be impacted by this act. However, they will be divided in 3 groups that won’t have the exact same requirements and timeline.

-

Large Accelerated Filer: Companies with a public float** of more than $700M.

-

Accelerated Filer: Companies with a public float between $75M and $700M and > $100M revenue.

-

SRCs (Smaller Reporting Companies): Companies with a public float inferior to $75M or companies with a revenue lower than $100M (with public float not exceeding $700M).

** Public float is measured as of the last business day of the issuer’s most recently completed second fiscal quarter and computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the price at which the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market for the common equity.

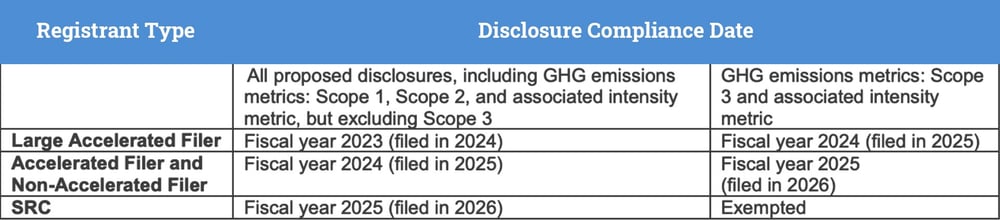

Key dates to remember

The disclosure requirements would start from the 2023 fiscal year (filed in 2024), starting with the group of Large Accelerated Filers.

Requirements

Required Disclosures

The registrants will be required to disclose information about:

Processes & Governance

-

How the management and board of the registrant organize the oversight and identification of climate-related risks.

-

What processes are used to identify, measure and mitigate the risks, what is their integration with the overall risk-management processes.

Vulnerability

-

How actual and potential climate-related risks impact the activity and financial statements of the registrant over the short, medium or long term.

-

How the registrant’s strategy and business model is (or is likely to be) impacted by those risks.

-

Assessment of the impact of climate-related events (e.g. severe weather events) to the registrant’s consolidated financial statements.

Planification & Targets

-

If the company has adopted any plan regarding climate-related risk management, it must publish a description of the action plan, the targets and the metrics used to monitor progress.

-

If the company used the method of scenario analysis, the scenarios, the assumptions and the projected impacts must be disclosed as well.

-

If the registrant has implemented a carbon price, it must be disclosed.

Impacts in terms of GHG emissions

————————— NOTE ON GHG EMISSION CALCULATION —————————

Scope 1: Direct emissions from the company (company facilities and vehicles)

Scope 2: Emissions derives from purchased energy for own use

Scope 3: Emissions from upstream and downstream activities (purchased goods, transportation, employee commuting, use of sold products, end of life-treatments...)

Aggregated: All the emissions calculated in CO2 equivalents.

Disaggregated: Detail per greenhouse gas (CO2, Methane, Nitrous Oxide, HFCs, PFCs and SF6)

Absolute terms: Total amount of emissions over a defined period.

Intensity terms: Emissions per unit of economic value or per unit of production.

———————————————

Registrants must separately disclose both their Scope 1 and Scope 2 emissions. The reporting must be in aggregated and disaggregated ways, and in absolute and intensity terms. Carbon offsets are not required.

-

Scope 3 emissions must be disclosed if they are significant or if the registrant has reduction targets including Scope 3 emissions. They have to be disclosed both in absolute and in intensity terms, without including carbon offsets.

-

If the registrant has committed to any target of GHG emission reduction, the plan must be disclosed according to the “Planification & Targets” requirements.

Disclosure dates and requirements per type of company

For explanatory purposes, this table assumes that the proposed rules will be adopted with an effective date in December 2022 and that the filer has a December 31st fiscal year end.

Presentation and Attestation of the Proposed Disclosures

-

The climate-related disclosures must be provided in the registration statements and annual reports.

-

The quantitative disclosure requirements must appear in a separate section of the registration statements and annual reports.

-

The qualitative disclosure requirements must be provided in a note to the consolidated financial statements.

-

Both qualitative and quantitative information must be electronically tagged in Inline XBRL*

* Inline XBRL is a structured data language that allows filers to prepare a single document that is both human-readable and machine-readable.

Consequences

The penalties for listed companies are not clearly defined yet but it is very likely that fines would be applicable as they are for non-compliance with Regulation S-K and Regulation S-X that define all the reporting requirements.

Risk Mitigation

The SEC is requiring listed US companies to build a complete overview of their social and environmental impact. It is clear that for the fashion industry (and many other industries), most of the impact and risk lies in the value chain. Even companies that will not be required to disclose their scope 3 emissions will need to implement traceability in order to do a proper social and environmental risk mapping. Traceability is a necessary step for the brand to understand and disclose its impact even if it is not the only requirement of these climate-related disclosure rules. Without specific knowledge on where the suppliers are established, their manufacturing processes and the materials and chemicals used in the products, most of the impact analysis will be unfounded.

How TrusTrace can help?

TrusTrace supports brands in their journey towards traceability with its different solutions, gathering data at company, product or at material level. Book a demo with the TrusTrace team to learn more about how TrusTrace can help you trace smarter and faster today.

Please note: At TrusTrace, we want to keep you informed on laws and regulations, but this information should not be considered or used as legal advice.